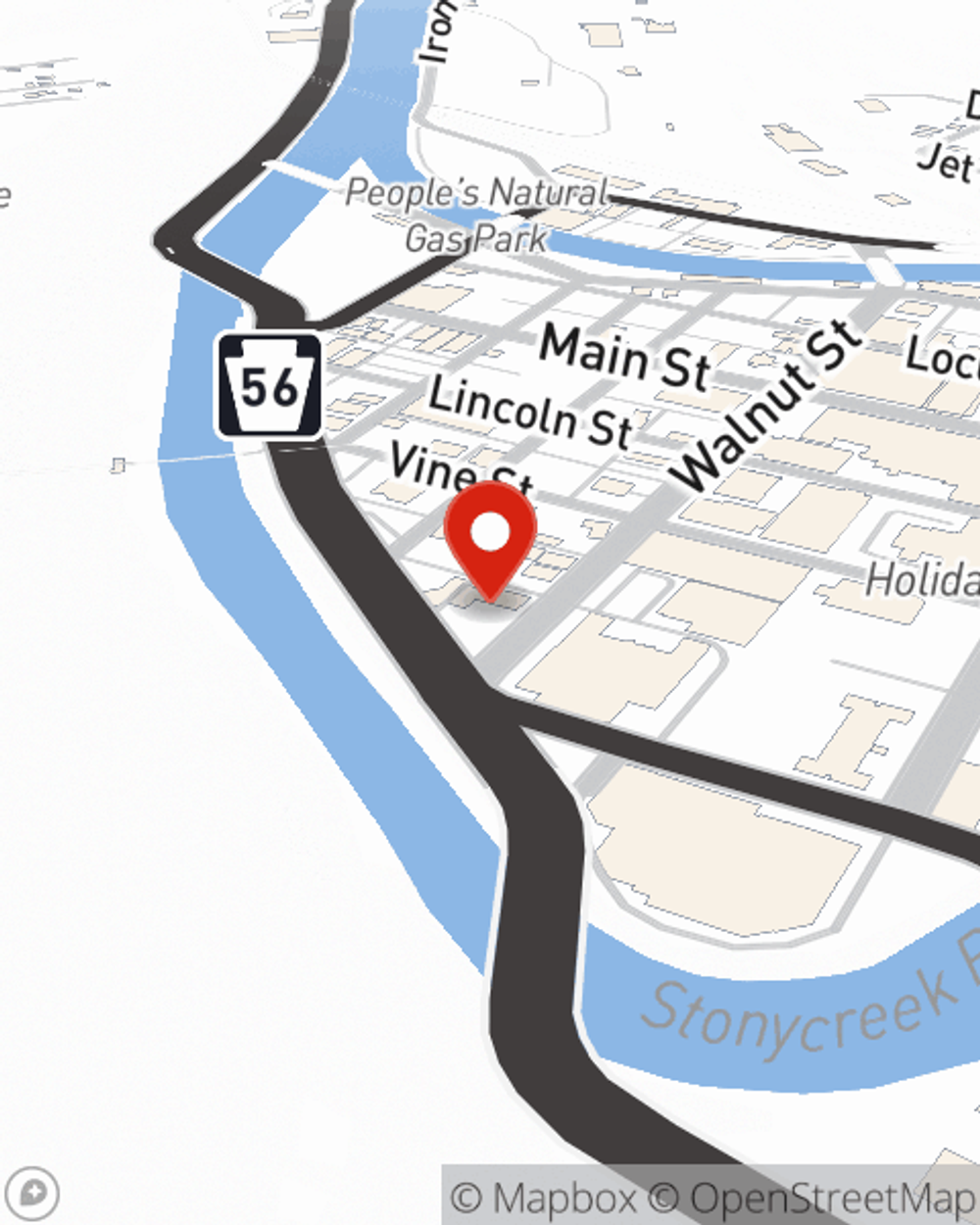

Renters Insurance in and around Johnstown

Get renters insurance in Johnstown

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Protecting What You Own In Your Rental Home

Home is home even if you are leasing it. And whether it's a condo or an apartment, protection for your personal belongings is a wise idea, even if your landlord doesn’t require it.

Get renters insurance in Johnstown

Coverage for what's yours, in your rented home

State Farm Has Options For Your Renters Insurance Needs

Many renters don't realize that their landlord's insurance only covers the structure. Your valuables in your rented space include a wide variety of things like your desk, coffee maker, tablet, and more. That's why renters insurance can be such a good choice. But don't worry, State Farm agent Donna Christopher has the dedication and experience needed to help you evaluate your risks and help you protect your belongings.

Renters of Johnstown, get in touch with Donna Christopher's office to get started with your particular options and how you can save with State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Donna at (814) 535-6611 or visit our FAQ page.

Simple Insights®

How do I know how much renters insurance to buy?

How do I know how much renters insurance to buy?

For renters insurance, finding the right balance means choosing accurate, appropriate limits for your personal property and liability coverage.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

Donna Christopher

State Farm® Insurance AgentSimple Insights®

How do I know how much renters insurance to buy?

How do I know how much renters insurance to buy?

For renters insurance, finding the right balance means choosing accurate, appropriate limits for your personal property and liability coverage.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.